Get Out Of Debt

How To Get Out Of Debt 5 Simple Steps Simplifi By Quicken Blog

8 Reasons To Get Out Of Debt

How To Get Out Of Debt In 7 Strategies That Work The Motley Fool

How To Get Out Of Debt Without Gimmicks Or Games Get Rich Slowly

5 Mistakes People Make Trying To Get Out Of Debt

Top Tips On How To Get Out Of Debt Warrior Trading

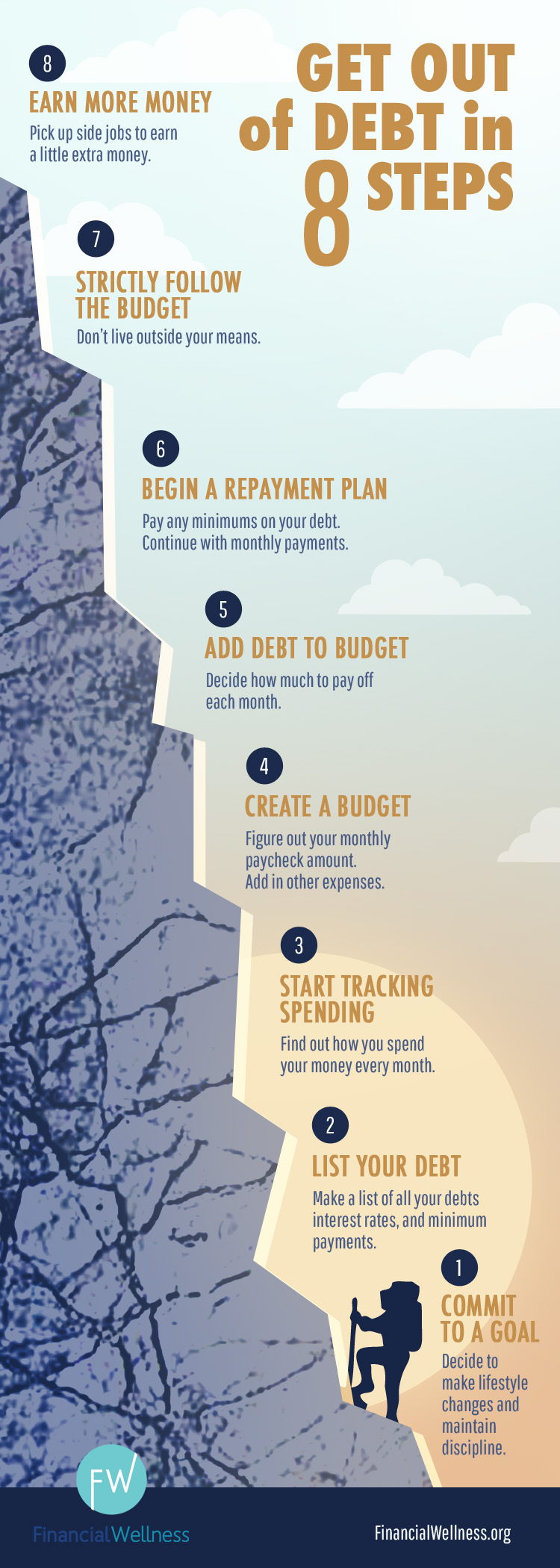

Putting all you numbers on one piece of paper is the best way to get started.

Get out of debt. Include your mortgage, vehicle loans, student loans, other types of loans, accounts in collection and. We'll show you how. Make a list of all your debts.

Having a positive number leftover is good!. Order your debts from highest interest rate to lowest interest rate to save the most money (debt avalanche). Those That File Bankruptcy Do Better Than Those That Don’t.

If you have a lot of debt at a high interest rate, the best way to get out of debt is probably debt consolidation with a personal loan. Pay more than the minimum payment. Figure out what you should pay first.

10 Easy Steps to Get Out of Debt Quickly. Many of the more than 30 million Americans who are out of work because of the COVID-19 pandemic are already struggling with debt – either trying to get out of it or hoping to avoid accumulating more of it. Knowing the balance amount of how much debt you owe is half the battle.

You have to figure out how to pay more. The Fine Art of Getting Out of Debt. Reduce your temptation to create more debt by cutting up your credit cards or even freezing your credit.

On the contrary, I’m telling you this to prove that it is possible to get out of debt, even if you’re buried in bills, earning a less-than-stellar income, and financially overwhelmed. Both also provide exemptions that let you keep certain assets, though how much is exempt depends on your state. With all those payments going out each month, there's nothing left for you.

Make 19 the year you resolve to start getting out of debt. The Ultimate Coronavirus Emergency Get Out of Debt Guide. The Ultimate Coronavirus Emergency Get Out of Debt Guide.

Live on rice and beans. If you want to get out of debt by yourself, you need to earn enough money to survive AND enough money to pay down your debts. While debt may be the cause of much stress and worry, there are many ways to get out of debt.

Pay More Than the Minimum. Chapter 13 bankruptcy can help you restructure your debts into a payment plan. If you want to get out of debt fast, you have to stop using debt to fund your lifestyle.

Get in the right mindset. Once you’ve experienced debt free living as an adult, I’m confident that you won’t want to go back to living under the crushing weight of monthly payments. How to Try to Get a Refund From a Debt Relief Company.

Then, pay off the cards with the highest interest rates first, trying to always pay more than the minimum. In fact, America's total debt tops $21 trillion, and in fiscal 18, we paid some $325 billion to service our. The Ultimate Guide to Dealing With Student Loans You Can’t Afford.

The Ultimate Guide to Dealing With Student Loans You Can’t Afford. Filing for Chapter 7 bankruptcy wipes out unsecured debt such as credit cards, but not without consequence. Learning to how to budget;.

You need to go from a situation in which you’re spending more than you earn into one where you’re earning more than you spend. List Everything You Owe. Having some debt is the norm, but if your debt compounds and becomes unmanageable, you’ll need to know the steps to getting out of debt.

There is a. If you have a setback (which you probably will), just don’t give up trying to get out of debt. This gives you milestones to celebrate, motivates you to keep going, and keeps you organized along the way.

If you are struggling to answer the question of how to. But as much debt as we have, most people don’t really know that much about it until they face issues. Taking control of your debt problems will give you peace of mind.

Good for you for looking for ways to get out of debt fast. It won't work if you're feeling miserable. Finally, one of the best ways to get out of debt — and what ended up being the crucial factor for me — is to earn more money.

Stop spending at random and make a plan. They paid it off in 1.5 years. Follow these steps to help you get out of debt, remain debt-free in the future and build good credit for the long haul.

As I mentioned earlier, getting rid of debt doesn’t just happen magically. Creating emergency and retirement funds;. The Money Advice Service says… Debt can be a difficult subject to talk about and it’s great to hear Hayley’s story of how she managed it herself.

This alone won’t get you out of debt, but at least your debt won’t get worse. So, if you are tired of paying for your past, and ready to do what it takes to get out of debt fast, you have come to the right place. How to Get Out of Debt With Frugal Living and Smart Shopping.

To get out of debt, you've got to change your habits. You CAN Get Out of Debt Fast. When you subtract your income ($4,910) from your list of expenses ($4,448.99), you end up with a total of $461.01.

While cutting costs might free up a few hundred every month, a solid. Like many of the other apps, its main focus is to get you out of debt the fastest and easiest way possible while emphasizing the Debt Snowball Method. Debt that typically does not get discharged in bankruptcy includes child support obligations, alimony, student loans, tax debt, and fines and debt you owe for breaking the law.

You’ve probably heard this a thousand times—but are you doing it?. That doesn’t have to mean a new job or a raise—although those would help. To pay off your debt, you need to know exactly how much you owe:.

Find over 27 Get Out of Debt groups with 3419 members near you and meet people in your local community who share your interests. The best way to get out of debt is to compile all of your bills, look at all of your accounts, jot down interest rates, and list everything in a spreadsheet. As newlyweds and recent graduates with $,000 in debt, Johnny and Joanna Galbraith were determined to create an attack plan and get out of the red.

How to Try to Get a Refund From a Debt Relief Company. If you carry the average credit card balance of $15,609, pay a typical 15% APR, and make the minimum monthly payment of $625, it will take you 13.5 years to pay it off. En español | When getting out of debt is a priority, there are several things you can do to eliminate that debt entirely — or at least pay off most of it — in 12 months or less.

Getting out of debt involves more than just paying off a few credit cards. The average American household has over $8,300 worth of debt. It can simply mean taking on a side gig or other tactic to add some extra money for a time.

In the meantime, make only minimum payments on the other debts. Read them and put them in place for you. Make A List of Your Debts and use the Snowball Method For some, you could figure this out in your head, but for others, you might want to get out a pencil and paper and write down all the debts you owe and use the Dave Ramsey Snowball approach below:.

Those That File Bankruptcy Do Better Than Those That Don’t. Knowing who and how much you owe;. Here are seven tips to get out of debt.

It means changing spending habits;. Always check with your bankruptcy attorney about which debt you owe that can and cannot be discharged. There is a process and in the following sections, you will learn how to get out of debt as quickly as possible.

If you send the letter within 30 days of getting the validation notice, the collector has to send you written verification of the debt, like a copy of a bill for the amount you owe, before it can start trying to collect the debt again. As you are about to discover, the debt snowball method (and debt avalanche) are the most cost effective, fastest, and emotionally satisfying ways to get out of debt. Say you have a $10,000 balance on a credit card with a 15% annual.

If you only make your minimum credit card payments each month, it can literally take forever to pay off your balance. Why Income Based Student Loan Payments Can Be a Terrible Trap. And knowing where to find help when you get off track.

Let’s dive right in. Consider reaching out to a non-profit credit counseling service located at many universities, military bases, credit unions and branches of the U.S. — Get Out of Debt (@getoutofdebtcom) March 6, 18.

You can be debt-free. Download this Snowball Debt Calculator and Plan to Get Out of Debt If you're struggling with paying down credit cards or loans, the "Snowball Method" gives you a way… Read more. The author also says that you should set up your spending plan in such a way that you're living comfortably.

You also can get a collector to stop contacting you, at any time, by sending a letter by mail asking for. If you’ve found yourself in a mound of debt, you’re not alone. The Fine Art of Getting Out of Debt.

The Debt Manager app costs $0.99 and offers its users with a clean interface. Stop going out to eat. Another way to get out of debt is to earn more money.

In this example, our income is $4,910. The best way to pay down debt is to focus on one piece of debt at a time until that one debt is entirely paid off. The higher your interest rates, the more you’ll have to pay to wipe out your debt—and possibly the more time it will take.

This means no more financing furniture, no more signing up for credit cards, no more test driving brand new cars that you don’t have the cash to pay for. If you don’t give up, then you can’t fail. Joy now runs a company, Crush Your Money Goals, where she helps others get out of debt through classes and community accountability.

And that’s only if you don’t add to the balance in the meantime, which can be a challenge on its own. If you continue adding debt, it will be much more difficult to make progress on reducing your debt, if you make any progress at all. Here are 10 tips and strategies to get you started on a debt-free life:.

You deserve to be debt free. Setting financial goals. Why Income Based Student Loan Payments Can Be a Terrible Trap.

It's too tempting to spend money in the moment if you don't have a plan in advance. Here’s how to get out of debt quickly. A big part of getting out of debt is understanding that you can get out.

If you don’t have any savings set aside when disaster strikes, it’s easy to fall further into the cycle of debt with just one. But you need to make sure you’re putting your money to its best use. How to Get Out of Debt Using a Debt Snowball.

Both types of bankruptcy may get rid of unsecured debts like credit card or medical debt and stop foreclosures, repossessions, garnishments and utility shut-offs, as well as debt collection activities. Despite the total debt you have, there are ways to deal with each situation. If you’re among them, it will be almost impossible to get out of debt and start saving for your future.

Bump up your debt repayment percentage. You have a couple of options;. This strategy involves applying for a personal loan with a.

Make sure that you always pay more than your minimum payments on you credit cards, overdraft, or line of credit. Break up with. To avoid accruing more debt on those cards, make a budget for expenses and try to stick to it.

Find a cheaper home, get a roommate, move in with your parents, or move to a place with a lower cost of living. Follow This Plan to Get Out of Debt As Quickly As Possible. To get out of debt, start by calling your credit card company and asking them to lower your interest rate.

The debt is not going to disappear overnight, but over a year or two, if you follow the plan, your debt should be cut in half or zero out entirely. Here are the Steps to Get Out of Debt Fast 1. For example, it’s nearly impossible to get out of debt in a reasonable amount of time if you’re just paying the monthly minimums against what you owe.

For example, let’s say Credit Card A has a balance of $1,000 and a 12% interest rate, and Credit Card B has $1,500 at 6% interest. These steps will help you formulate a system that will allow you to get out of debt fast. You can save a ton of money just by showing a coupon to.

Stop Creating More Debt. Even if you are at 30% or under, if you have debt, this needs to change. If you’re working to better understand debt and the options you have to get out of it, start here.

Putting at least 15 percent of your paycheck — or income from Social Security or pensions. The more of these you can apply, the faster you will get out of debt. Develop a Starter Budget.

To get out of debt the absolute fastest, you’re going to want to pay off the loan with the highest interest rate first.

The Ultimate Guide To Getting Out Of Debt

5 Ways To Get Out Of Debt Military Com

12 Ways To Get Out Of Debt My Money Coach

How To Pay Off Debt Fast With Low Income Magnifymoney

How Debt Consolidation Affects Your Credit

How To Get Out Of Debt During The Covid 19 Pandemic

10 Ways To Get Out Of Debt Fast Tips For Paying Off Debt Credit Org

How To Get Out Of Debt 10 Practical And Mindset Tips The Curious Frugal

How To Get Out Of Debt With Your Own Yearofno

How To Get Out Of Debt Stay Out Of Debt And Live Prosperously Based On The Proven Principles And Techniques Of Debtors Anonymous Jerrold Mundis Amazon Com Books

How To Get Out Of Debt Spending Consolidation Advice Bankruptcy

How To Get Out Of Debt No Matter The Situation That Got You Into It Glamour

Savvymoney Blog

How To Get Out Of Debt 10 Practical And Mindset Tips The Curious Frugal

Change Your Habits Stay Out Of Debt Money Under 30

The Key Sacrifices To Get Out Of Debt Advantage Ccs

Amazon Com Debt Free Masterplan Rapidly Get Out Of Debt Build Wealth Master Money Management Proven Strategies To Save Money Pay Off Your Credit Card Beat Bad Credit Stop Compulsive

How To Get Out Of Credit Card Debt Real Simple

How To Get Out Of Debt 7 Simple Steps To Break Free Financially Intuit Turbo Blog

1

Yes You Can Get Out Of Debt Arsenal Financial Llc

Learning To Get Out Of Debt Aspire Federal Credit Union

Q Tbn 3aand9gcqydandtb1vddj5ai4egksu8mla1otk 6cigxog17a2ekiztds3 Usqp Cau

Get Out Of Debt Frugal Confessions How To Save Money

Staying Out Of Debt Once You Get Out Of Debt Gcg Financial

17 Reasons Why You Should Get Out Of Debt Benefits Of Being Debt Free

How To Get Out Of Debt Kiplinger

How To Get Out Of Debt In 7 Steps Clark Howard

How To Get Out Of Bad Debt For Good Wealthfit

10 Tips To Getting Out Of Debt Little Things Matter

Get Out Of Debt 7 Tips From People Who Did It Latina Lista News From The Latinx Perspective

8 Ways To Get Out Of Debt In Credit Com

How To Pay Off Debt Fast

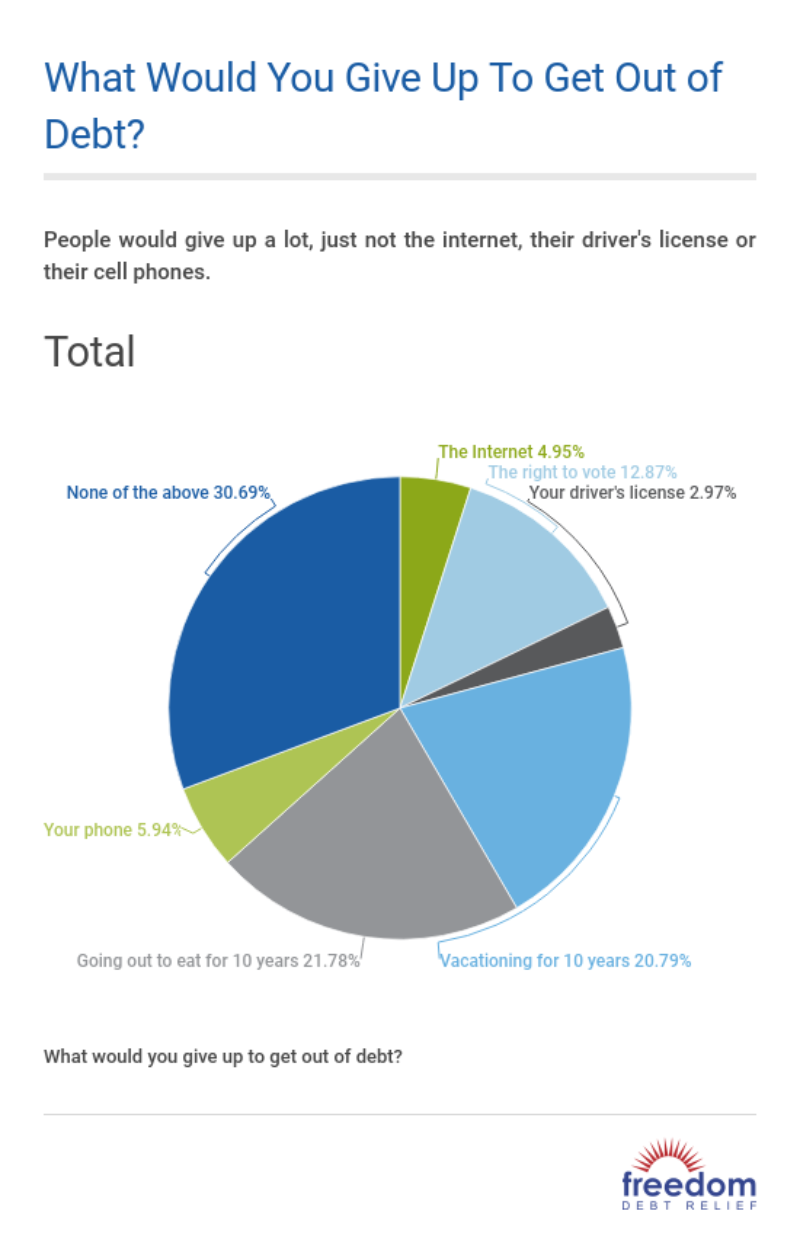

Would You Give Up 10 Years Of Vacations To Get Out Of Debt The Basis Point

Debt Relief Help Get Out Of Debt With A Debt Management Plan

How To Get Out Of Debt Bankrate

How To Get Out Of Debt Fast A Step By Step Guide

How To Get Out Of Debt Take The Right Steps To Get Debt Free Debt Com

How To Get Out Of Debt Qfinance

9 Reasons Why You Re In Debt It Starts With Your Behavior

Effective Ways To Get Out Of Debt Without Breaking The Bank

Pay Off Your Credit Card Debt Iwt Style I Will Teach You To Be Rich

How To Get Rid Of Credit Card Debt Fast 5 Step System Swift Salary

/GettyImages-1093086154-058134c8013c4dba80e8fbd13289c7ab.jpg)

Clever Strategies That Can Help You Pay Off Debt

How To Get Out Of Debt How We Paid Off 37 000

How To Get Out Of Debt In Just 7 Steps To Start Off 19 Updated

Q Tbn 3aand9gcs Gxt93oavgfkkusav1gnc4fxhdry8nldjed4ax4 Sid Cpwur Usqp Cau

Getting Out Of Debt Joyfully Milasas Simone Amazon Com Books

How To Get Out Of Debt Pay Bills Down Fast

11 Costly Mistakes To Avoid When You Want To Get Out Of Debt The Kickass Entrepreneur

How To Get Out Of Debt In One Year Money Under 30

Getting Out Of Debt Top Strategies Programs And Ideas To Help You Get Back In The Black

The Get Out Of Debt Free Post Be More With Less

How To Get Out Of Debt Fast Complete Guide With Action Plan

How To Get Out Of Debt Living Paycheck To Paycheck Arrest Your Debt

Federal Reserve Board Federal Credit Union

How To Get Out Of Debt The Ultimate Plan For Getting Out Of Debt Even If You Have No Money Celebrating Financial Freedom

How To Get Out Of Debt Fast With Low Income In A Year The Best Way Ovlg

5 Tips For Getting Out Of Debt Quickly S Debt Elimination Guide

How To Get Rid Of Debt Fast

How To Pay Off Debt Fast Npr

The 3 Step Guide For Getting Out Of Debt Payactiv

How To Get Out Of Debt Now

The Secret To Getting Out Of Debt In Dynamic Money Financial Plans Built For Life

How To Get Out Of Debt Dave Ramsey Rant Youtube

6 Most Effective Steps That Will Help You Get Out Of Any Debt Quickly

9fnwrlw6i8f1tm

8 Ways To Get Out Of Debt

How To Get Out Of Debt And Build A Wealth Snowball

4 Great Personal Finance Books To Help You Get Out Of Debt

Get Out Of Debt Alternatives Incharge Debt Solutions

How To Get Out Of Debt Take The Right Steps To Get Debt Free Debt Com

115r How To Get Out Of Debt Choosefi

25 Ways To Get Out Of Debt Daveramsey Com

Living Paycheck To Paycheck Getting Out Of Debt Consolidated Credit

A Guide On How To Get Out Of Debt

How To Get Out Of Debt Quickly According To Financial Experts Business Partner Magazine

How To Get Out Of Credit Card Debt Debt Com

30 Quotes To Help You Get Out Of Debt Real Pdl Help

How To Change Your Habits To Get Out Of Debt And Stay Out

How To Get Out Of Debt Quickly In 4 Simple Steps

Choose Accc To Help Get Out Of Debt Talking Cents

How To Get Out Of Debt On Your Own A Diy Guide

The Ultimate Cheat Sheet To Get Out Of Debt In

Q Tbn 3aand9gctntlg68bwaodn Akfqck0ulvlscnz8gjgcas3nnkabw Vvsjsw Usqp Cau

How To Get Out Of Debt 11 Steps With Pictures Wikihow

How To Get Out Of Debt Strategies For The Small Business Owner

Getting Out Of Debt Is A

How To Get Out Of Debt Fast When You Are Broke As Hell

How To Get Out Of Credit Card Debt On Your Own Exhaustive Guide

Rich Dad Scam 7 Get Out Of Debt

The Definitive Guide To Get Out Of Debt Fast And Forever

4 Ways To Get Out Of Debt The First National Bank Blog

Get Out Of Debt Take The Pledge And Then We Saved

Easy Steps To Get Out Of Debt According To A Certified Financial Planner Youtube

10 Ways To Get Out Of Debt Fast Tips For Paying Off Debt Credit Org

How To Get Out Of Debt In 5 Easy Steps Money Bliss

How To Get Out Of Debt With The Debt Snowball Plan Daveramsey Com