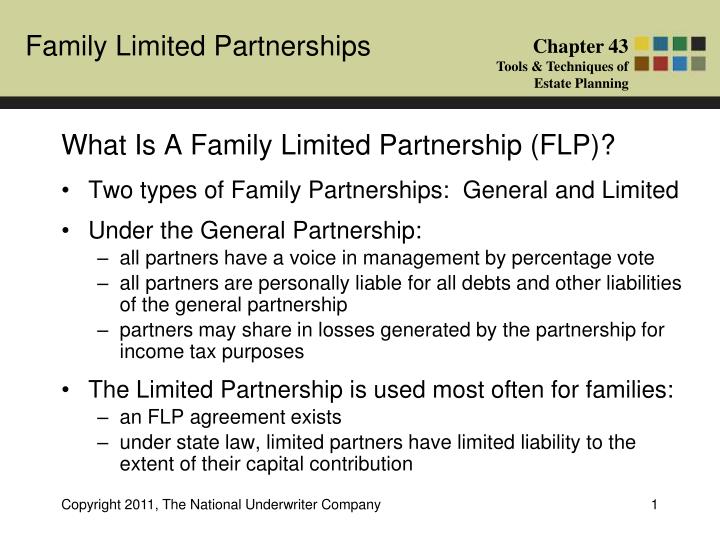

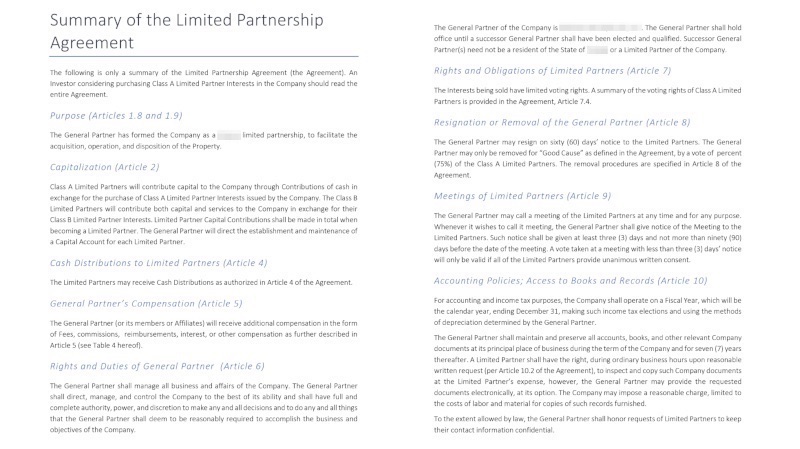

A Limited Partnership

Limited Partnerships A Brief Explanation Ionos

Chapter 15 Partnerships And Limited Liability Companies Ppt Video Online Download

10 Limited Partnership Agreement Templates Pdf Word Free Premium Templates

Limited Partnerships For Entrepreneurs With Silent Partners

.jpg?la=en)

Limited Partnerships And Their Personality Ashurst

Limited Partnership Example Advantages Vs General Partnership

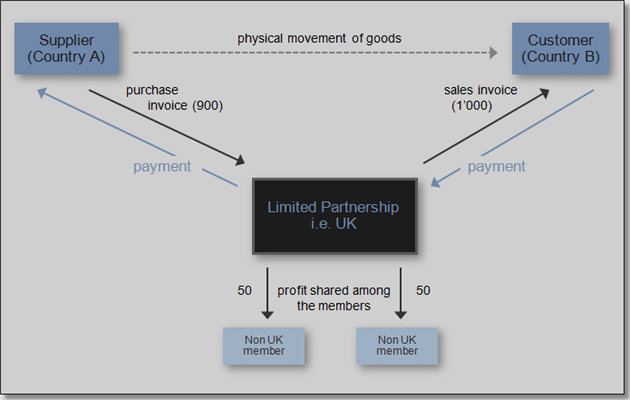

This means the shares of a limited partnership can be sold to any third party in other to raise capital that has an equity percentage.

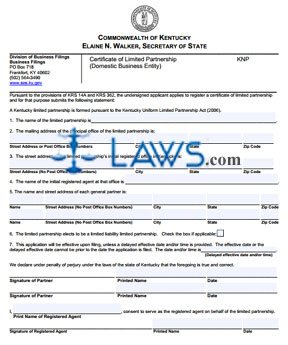

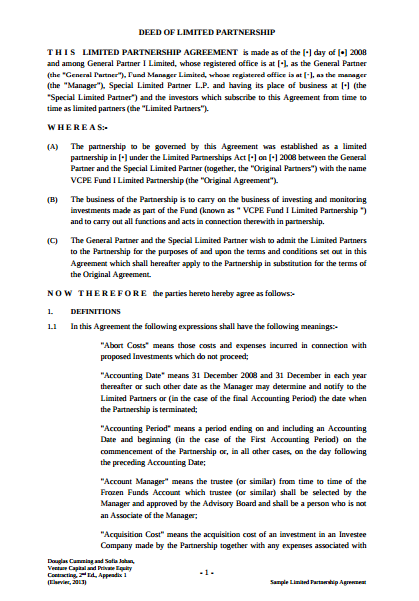

A limited partnership. This removes the requirement for a company to go public in order to sell shares. A Limited Partnership or Limited Liability Limited Partnership can specify an effective date up to 90 days after the date the document is received by our office. The general partner is in charge, making.

A limited partnership makes it easy for friends and family to pool money for major investments, such as starting a restaurant, building an apartment complex, or acquiring an existing company. Limited Partnerships do not have stock or stockholders. The Minority Quarterback by Ira Berkow.

The German Commercial Code recognizes several types of companies, among which partnerships.Foreign investors can set up two types of partnerships:. A limited partnership is a pass-through entity. Family limited partnership vs.

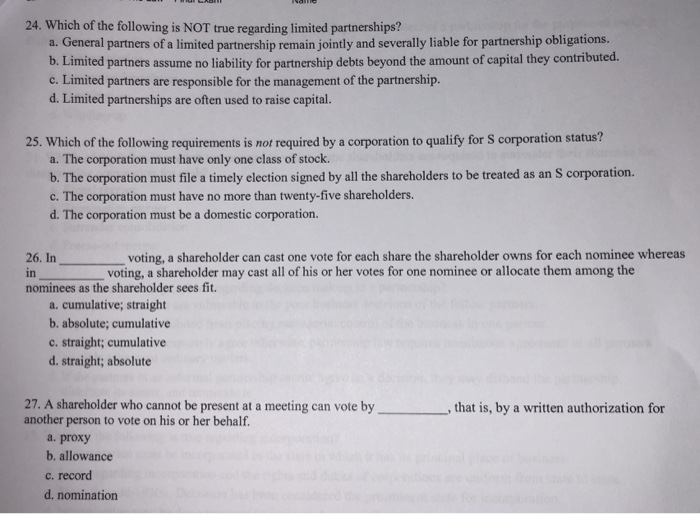

If any details have changed, you need to update the register before you file your annual return. When two or more partners form this kind of business, such partners will be liable only for the amount of capital each one invested into the business. In a limited partnership, the limited partners manage the business and are personally liable for all losses.

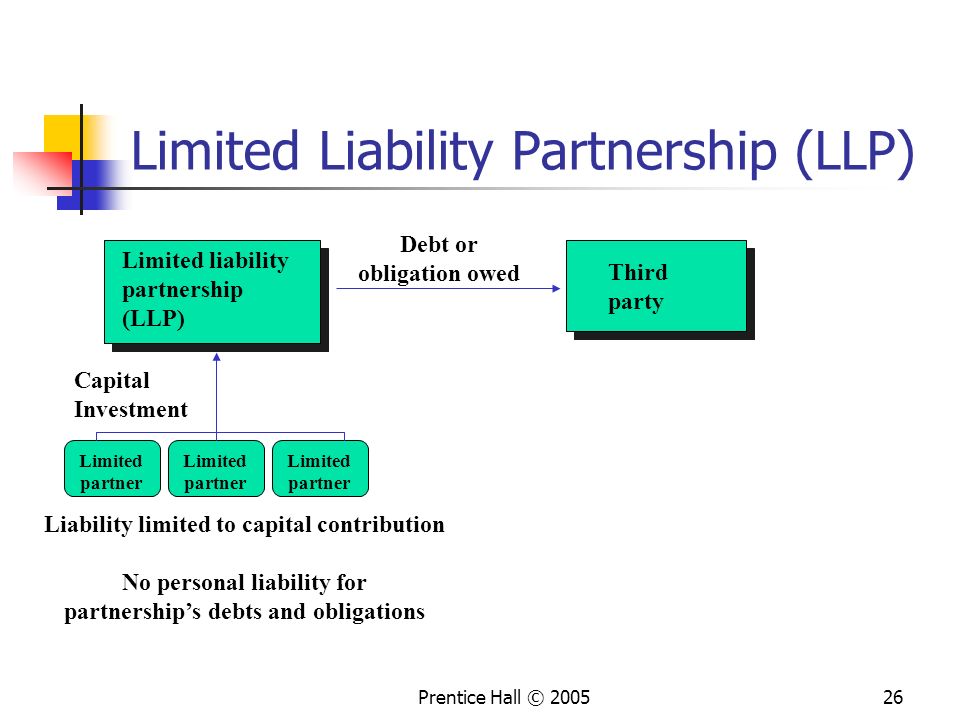

As the name suggests, an LLP provides its members with a degree of liability protection, shielding them and their personal assets. An investment partnership is a type of business formation. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner’s tax return (a disregarded entity).

This is a business vehicle introduced by ACRA in 09. Each Limited Partner has a specifically stated percentage of interest in. Generally, a partnership is a business owned by two or more individuals.

The limited partners in an LP invest their money but don't make any. A Limited Partnership by Amy Harmon. A business partnership between limited partners | Meaning, pronunciation, translations and examples.

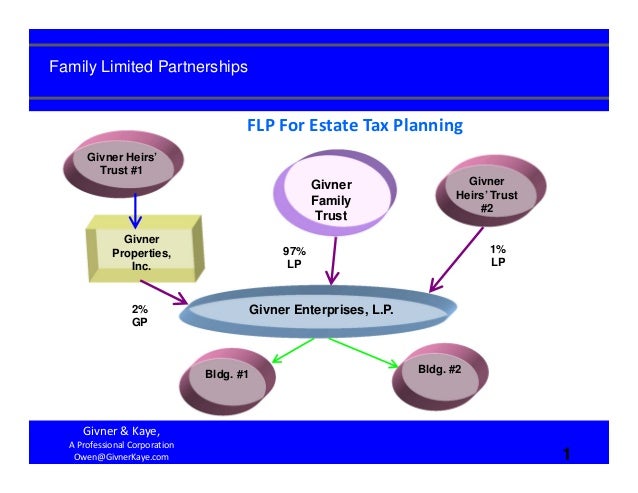

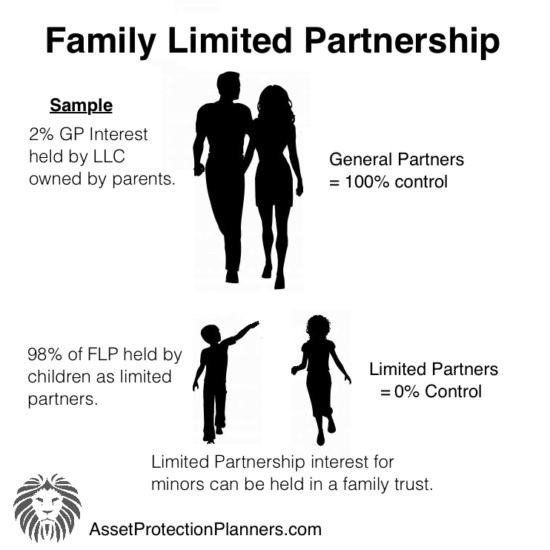

Family limited partnership vs. A limited liability company can have as many owners (known as members) as it would like. Unsurprisingly, this particular strategy is frequently used by successful and wealthy families.

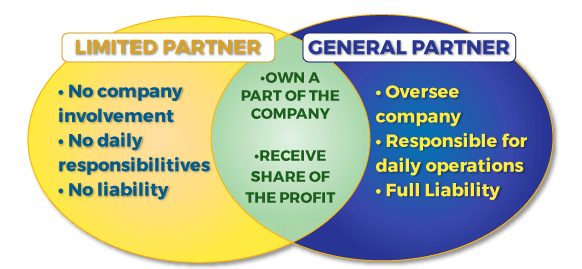

One who does not get involved in daily management and another who is involved in daily management and bears more personal liability. A limited liability partnership, or LLP, is a type of partnership where owners aren’t held personally responsible for the business’s debts or other partners’ actions. It is usually formed by at least one general partner (or full partner) and at least one limited partner (or nominal partner).

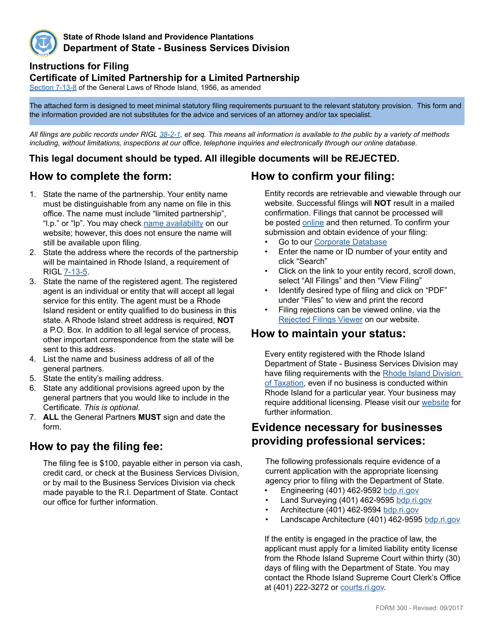

Each person contributes money, property, labor or skill, and shares in the profits and losses of the business. Information about your limited partnership, including your addresses, and details for your general and limited partners, must be confirmed on the Limited Partnerships Register every year by filing an annual return. A limited partnership is a form of general partnership, which is one of three ways of organizing a business in Canada:.

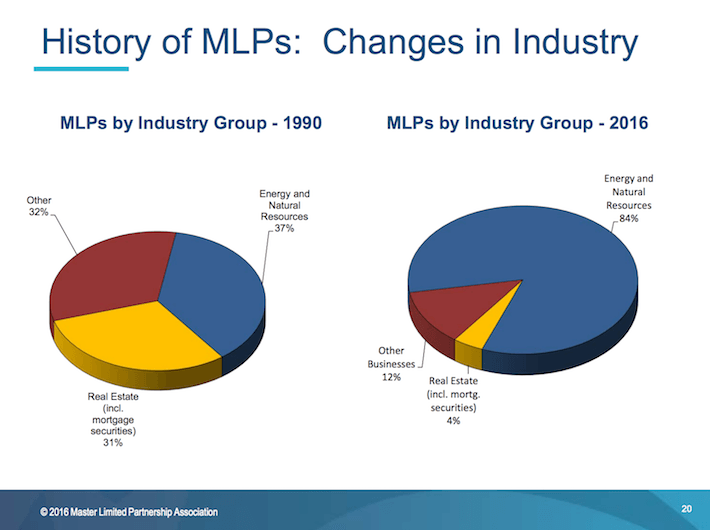

At a Slaughterhouse, Some Things Never Die by Charlie LeDuff. Limited partnerships, or limited liability partnerships, are generally established for real estate purposes. Limited Partnership or LP.

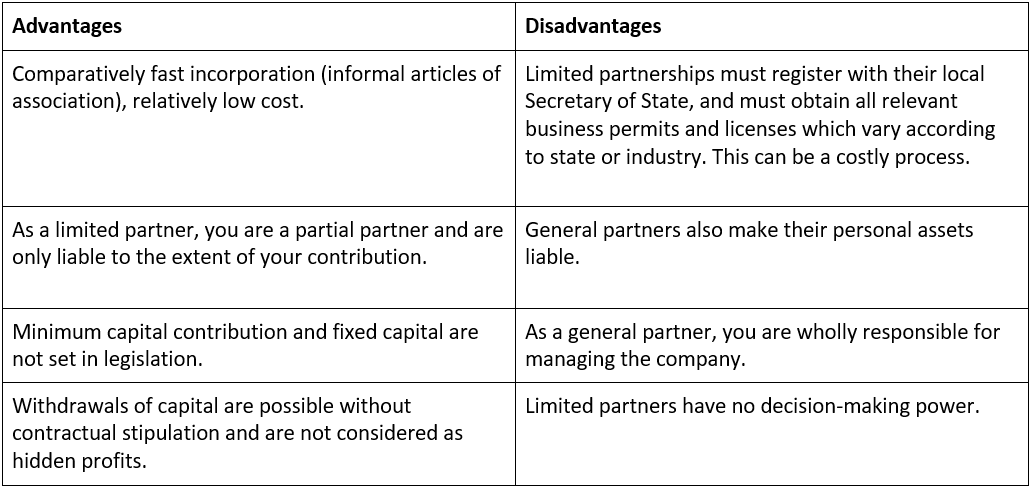

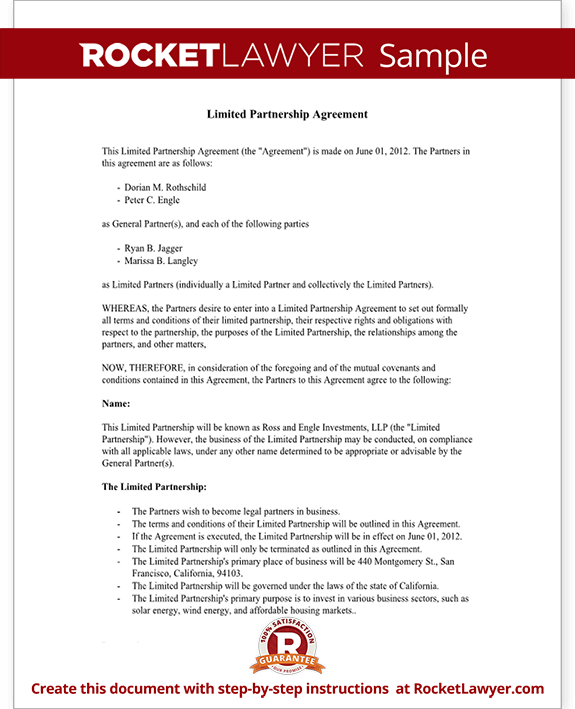

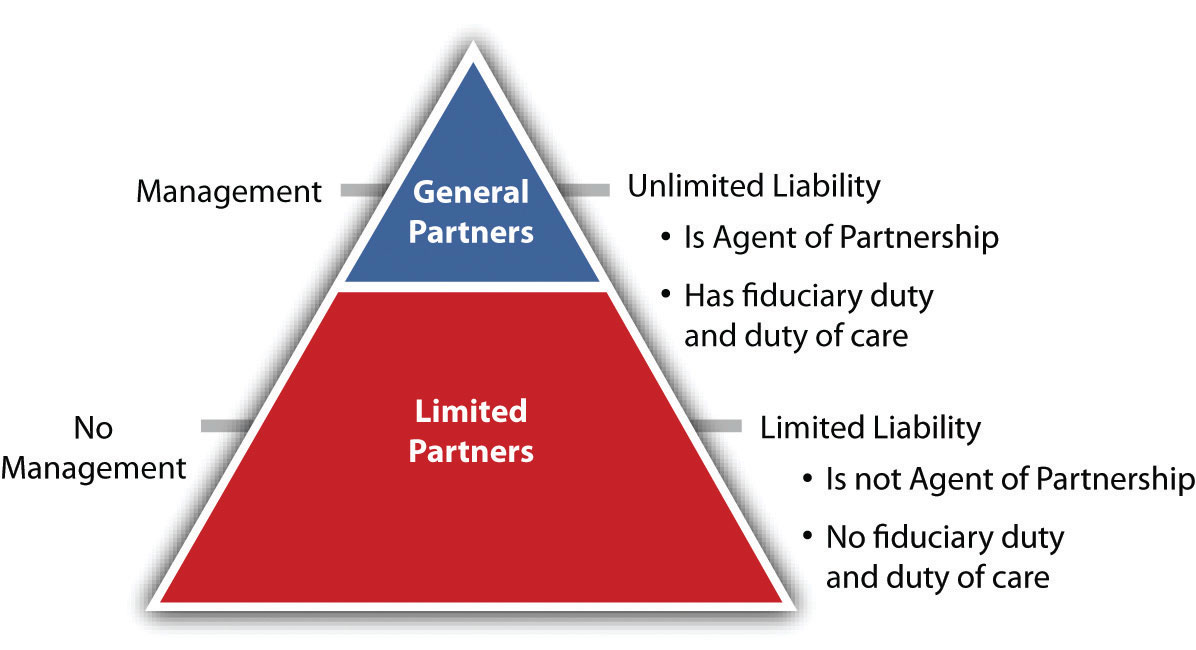

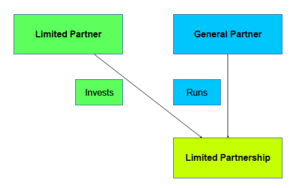

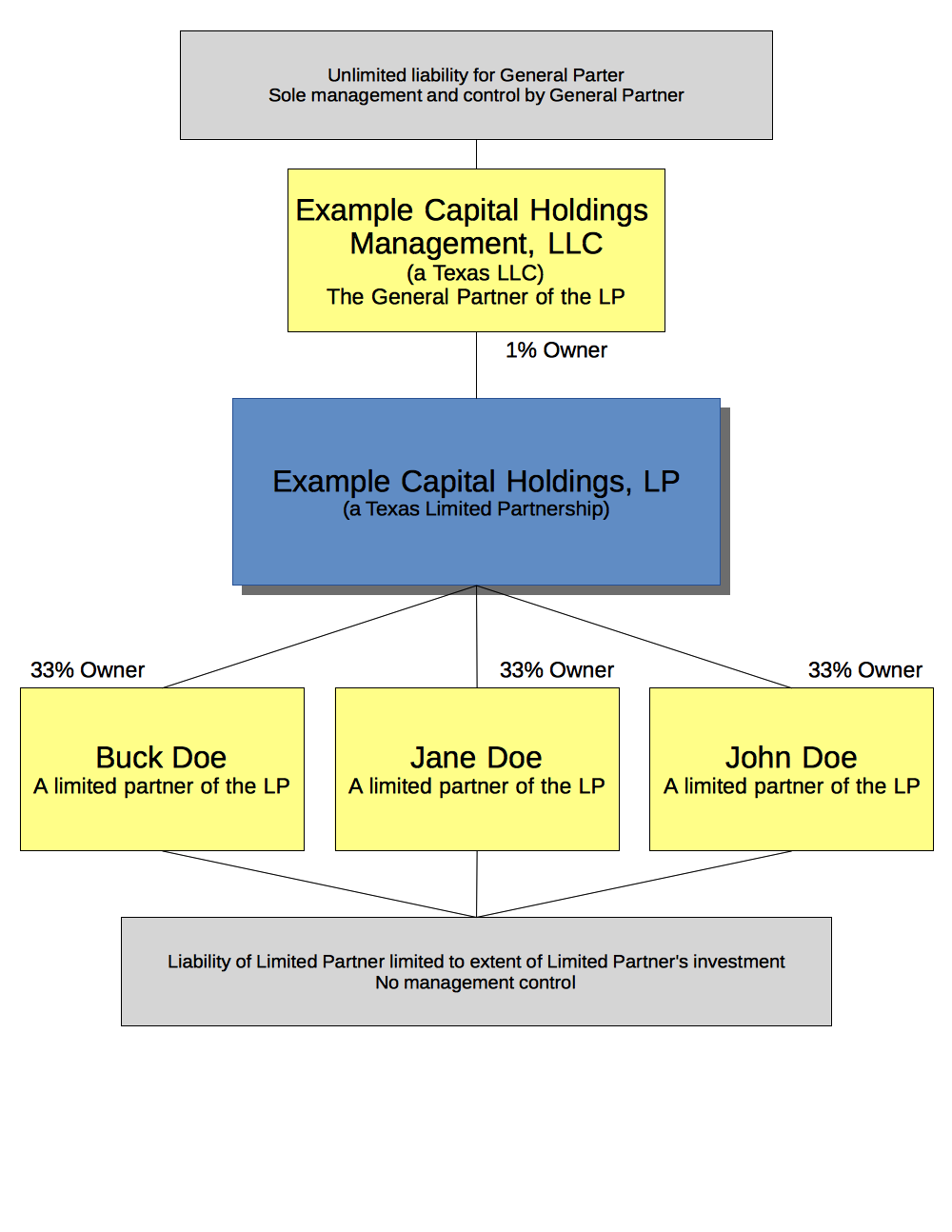

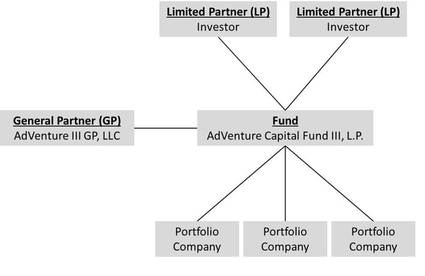

General partners and limited. General partners (who own and operate the business), and limited partners (who invest their money or property in the business, do not have the right to make decisions regarding the operation of the business, and do not have personal liability for business debts). Pros and Cons of Limited Partnership.

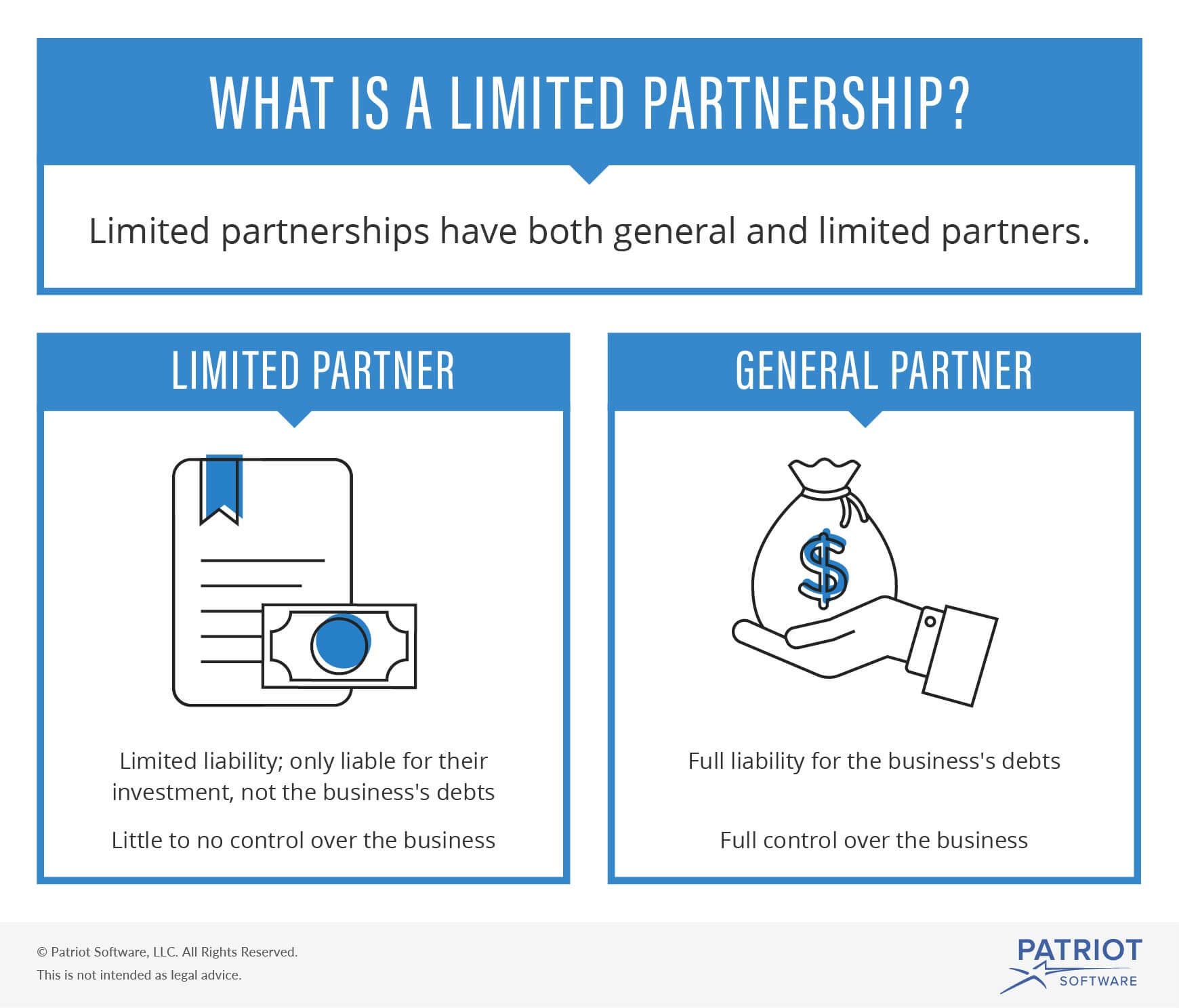

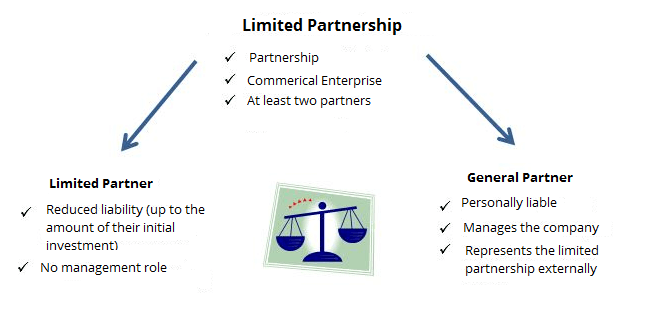

The limited partnership (Kommanditgesellschaft, KG) is employed not only in Germany, but also in Austria and several other European countries. Key Takeaways A limited partnership (LP) is a type of business that's owned by two types of partners:. A limited partnership exists between one general partner — who has unlimited liability — and one or more limited partners who have limited liability.

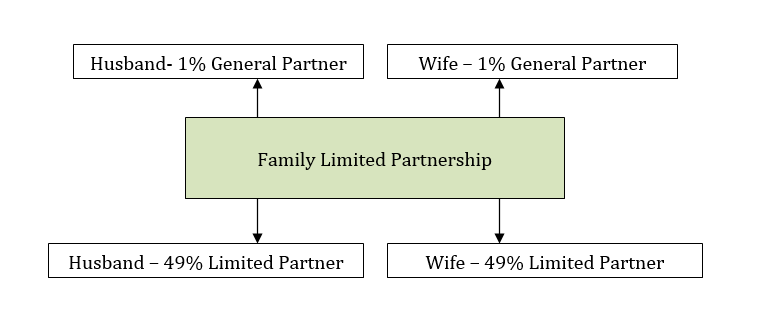

This is in direct comparison to the other person(s) within the business in the role of a limited partner. An FLP, however, is a business from which family members profit according to their proportion of general partnership shares and limited partnership shares. - general partnerships, - limited partnerships.

It's one of several types of partnerships, each with its own unique structure and benefits. Limited partners can invest in the business and share its profits or loss, but cannot be active participants in the day-to-day operations of the company. One or more general partner who manage the business of the partnership and one or more limited partners who do not participate in the management of the partnership and who have limited liability.

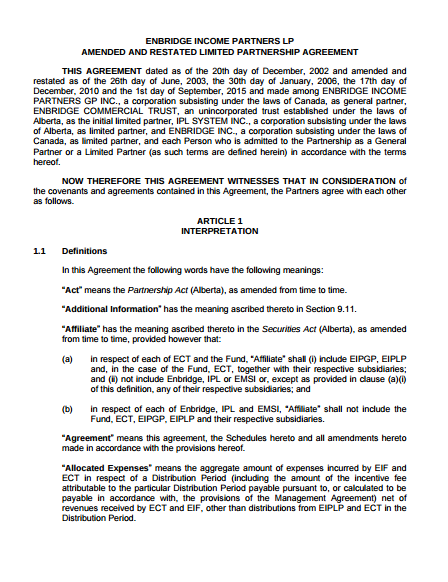

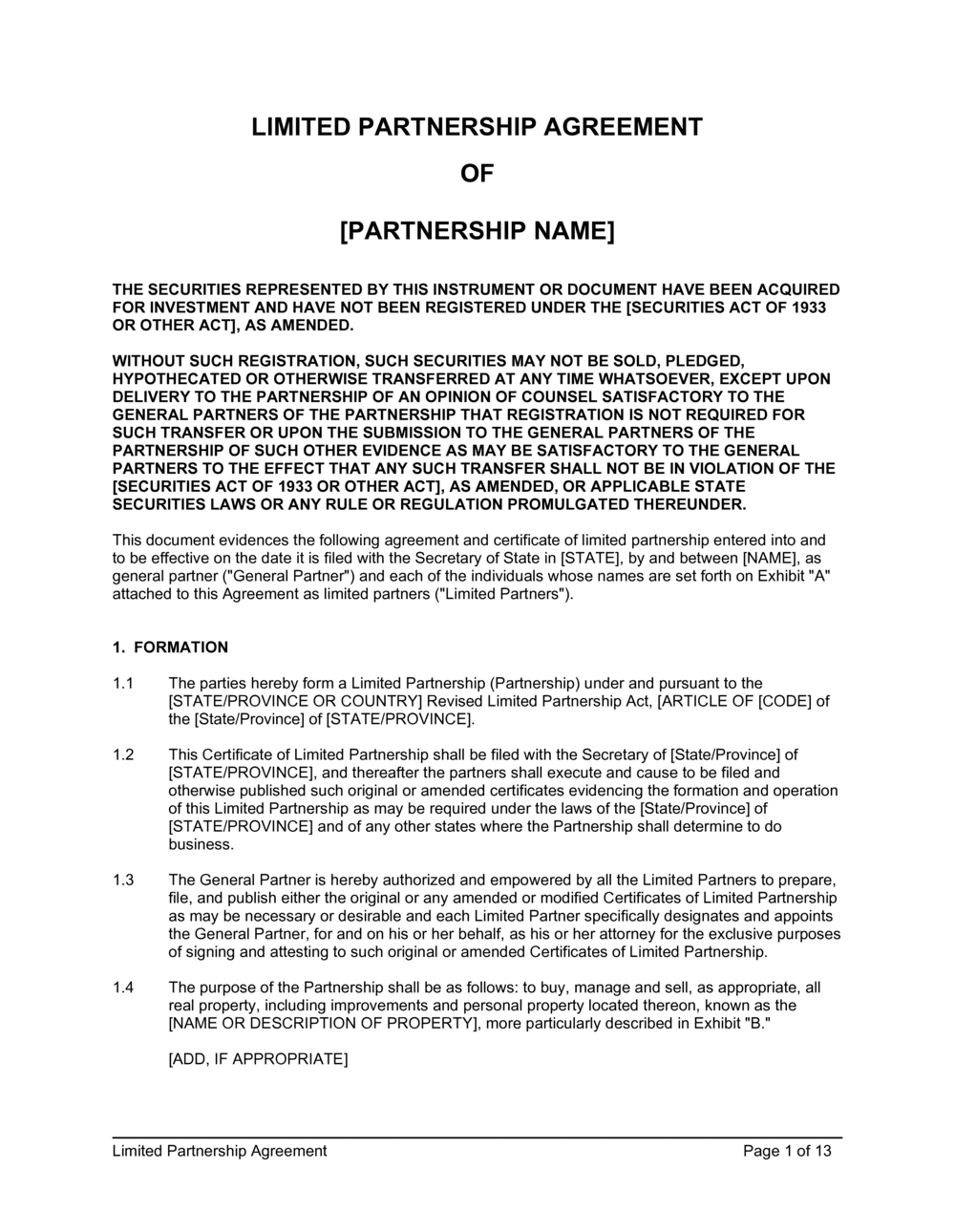

Limited partners are sometimes referred to as "silent partners" - in other words, they can make investments in the company but have no voting power or control over its day-to-day operations. The limited partnership is domestic in the state in which it is formed, and all matters having to do with the formation and operation of the limited partnership is controlled by the laws of that state. The limited partnership operates in accordance with a partnership agreement, written or oral, of the partners as to the affairs of the limited partnership and the conduct of its business.

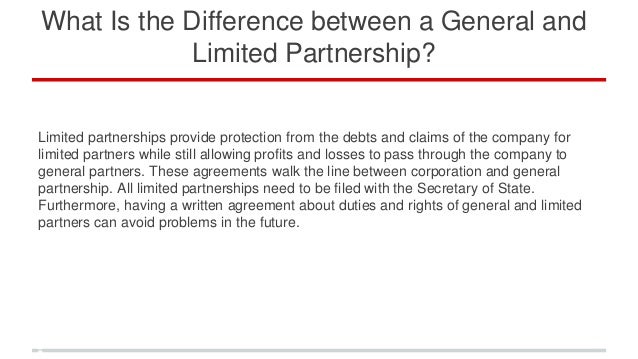

Limited liability partnerships (LLPs) allow for a partnership structure where each partner's liabilities is limited to the amount they put into the business. The Arizona Secretary of State files limited partnerships for the state of Arizona. Limited partners are only liable for the partnership’s debts equal to their investment in the partnership.

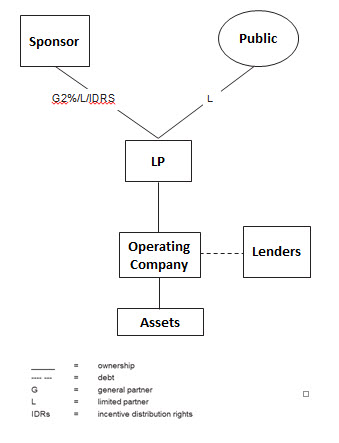

Limited Partnerships are typically formed by individuals or corporations who want to maintain 100% of the control of an asset or project while including investors or heirs on the income from the Limited Partnership. That person must have actual management authority for the day-day- activities of the company. A limited partnership contains at least one general partner and at least one limited partner.

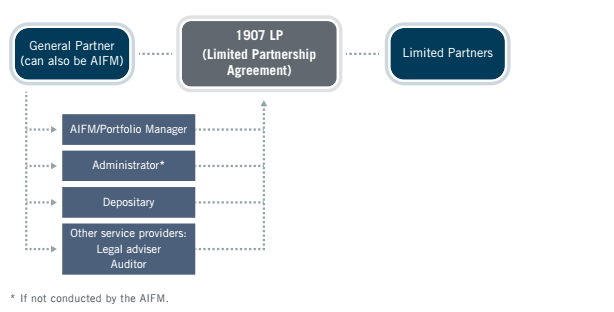

An indefinite lifespan if desired separate legal personality tax treatment for Limited Partnerships. In an ACS money or property (‘assets’) are pooled and managed on behalf of the partners. A list of activities that the limited partners can be involved in while not participating in the management of the.

This means economies of scale, access to better lawyers, accountants, bank services, and more. When to Campaign With Color by Timothy Egan. All limited partnerships, per A.R.S.

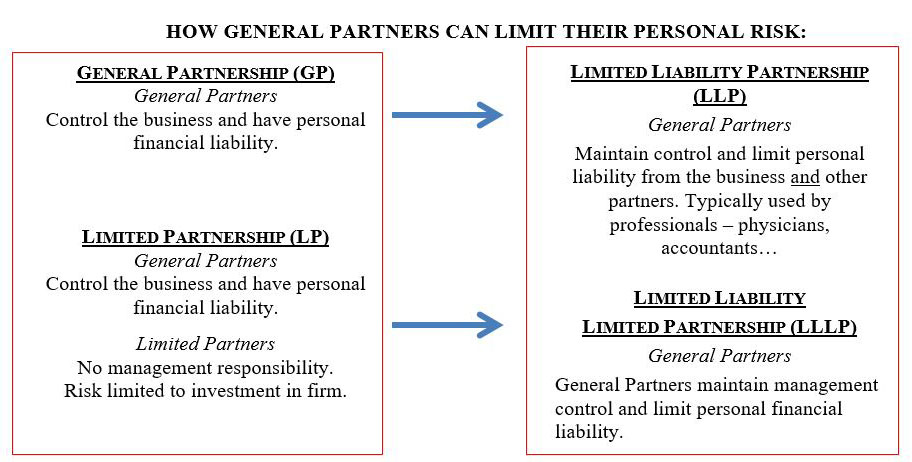

A business partnership is a for-profit business established and run by two. The definition of a limited partnership is a business with more than one owner, including at least one general partner and at least one limited partner. The limited liability limited partnership (LLLP) is a relatively new modification of the limited partnership.The LLLP form of business entity is recognized under United States commercial law.An LLLP is a limited partnership, and it consists of one or more general partners who are liable for the obligations of the entity, as well as or more protected-liability limited partners.

Growing Up, Growing Apart by Tamar Lewin. Publication 541, Partnerships , has information on how to:. Like a General Partnership, Limited Liability Partnerships allow partners to manage the business.

Having business partners means. General partners can apply for the limited partnership to act as an authorised contractual scheme (ACS). A corporate body can act as a Limited Partner or General Partner.

Arizona Revised Statutes (A.R.S.) Title 29 governs the filing and recording of limited partnerships. Features of Limited Partnerships include:. A limited partnership is formed by two or more entities and must have at least one limited partner and one general partner.

A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form. A limited partnership requires a written agreement between the business management, who is (are) general partner or partners, and all of the limited partners. A limited partnership (LP) has two kinds of partners:.

A special type of partnership which is very common when people need funding for a business, or when they are putting together an investment in a real estate development. The general partners in an LP make business decisions and take on full liability for the company. Limited partnership shares are considered securities.

Reaping What Was Sown on the Old Plantation by Ginger Thompson. Sometimes called “silent partners,” limited partners provide capital, but unlike in a general partnership, they can’t participate in business-related decisions. A Limited liability partnership (LLP) and a limited liability limited partnership (LLLP) are both created from existing general or limited partnerships, respectively, that file elections with the Bureau of Corporations and Charitable Organizations of the Pennsylvania Department of State, claiming LLP or LLLP status.

A Limited Partnership is similar to a General Partnership in almost every way, except that it is slightly more complex because it offers certain enhancements, including a framework that distinguishes the varying degrees of liability between what is known as a General Partner and a Limited Partner. A trust is a vehicle set up to hold property for the benefit of the trust's beneficiaries. Application for Registration of Foreign Limited Partnership (Form LP–5) — Foreign Limited PartnershipsIf the foreign limited partnership's name does not end with "limited partnership" or the abbreviation "LP" or "L.P.", in order to obtain a registration with our office, the foreign limited partnership must adopt, for the purpose of transacting business in California, an alternate name that.

A limited partnership (LP) is where two or more people own a business, but there are two classes of partners:. LLP stands for limited liability partnership. A limited partnership firm formed by general partners and limited partners, where the general partner(s) run the business and have liability and limited partner(s) has no day-to-day involvement in the business decision making.

Limited Partnership (LP) Understanding Limited Partnerships. A Limited Liability Company (LLC) is an entity created by state statute. It’s a partnership that’s generally.

The partners report the profits and losses of the business in their individual tax returns. Limited partnerships are generally very attractive to investors due to the different responsibilities of the general and limited partners. The Hurt Between the Lines by Dana Canedy.

A limited liability partnership (LLP) is a business structure that minimizes liability fo the partners and can reduce their tax obligations. Since the general partner has unlimited liability, they are personally liable for all the partnership’s business debts. Unlike a general partnership, a limited partnership has two categories of partner:.

A limited partnership is composed of general partners and limited partners. The other two are sole proprietorship and incorporation.Each of these has its own operational, accounting, tax and legal requirements. Limited Partners in an LP cannot take on management responsibility.

A great technique for lowering estate taxes and gift taxes is to form a family limited partnership, consolidate your assets within it, and then give part of the partnership away to your heirs each year. Limited Partnership Interest means, with respect to any Limited Partner, such Partner’s Units and Capital designated as a “Limited Partnership Interest” (including, for the avoidance of doubt, designation as a “Special Voting Limited Partnership Interest”) on Schedule 4.02 and Schedule 5.01 in accordance with this Agreement and rights and obligations with respect to the Partnership. If you are forming the entity between October 1 and December 31 st , but don’t expect to transact business until the next calendar year, avoid filing an annual report form for the.

A limited partnership allows for any number of "limited partners," whose liability is limited to the total amount of their investment in the company. A Limited Partnership, as compared to a general partnership, is formed by two or more people doing business.At least a person must act as the general partner. While the partnership agreement is not filed for public record, the limited partnership must file a certificate of formation with the Texas Secretary of State.

A limited partner’s liability for a partnership firm is limited to the invested amount in the company. The limited partnership interest that exist are considered to be securities. Business structure that combines features of a limited company with that of a partnership for use as a tax shelter, but does not create a legal entity separate and distinct from its owners.

Special Considerations for a. Partnership is the most common type of business structure for businesses with more than one owner. 29-301(7), two or more persons under the laws of this state and having one or more general partners and one or more limited partners.

Business profits (or losses) are distributed among the partners in the ratio of their ownership percentage. A Limited Partnership (LP) is comprised of at least one General Partner and at least one Limited Partner. A partnership is a form of business arrangement in which a particular business will be owned and operated by a number of people, known as partners of the business.

A partnership is the relationship between two or more people to do trade or business. Limited partnerships (LPs) and limited liability partnerships (LLPs) are both businesses with more than one owner, but unlike general partnerships, limited partnerships and limited liability partnerships offer some of their owners limited personal liability for business debts.

Limited Partnership Legal Services Durfee Law Group

Free Limited Partnership Agreement Free To Print Save Download

Limited Partnership Lp Definition

What Is The Difference Between Limited Partners Lps And General Partners Gps In The Venture Capital Business Quora

Opening New Accounts Why So Many Different Types Of Partnerships

The Advantages Of A Limited Partnership Structure For New Businesses Duncan Craig Llp

Limited Partnerships Business And The Legal Environment

1

May 21 Community Cinema Limited Partnership Wkar

Latham Watkins Llp Master Limited Partnerships Generic Content

File Chart Of A Limited Partnership Jpg Wikimedia Commons

How To Form A Michigan Limited Partnership Llc Formation Rocket

Family Limited Partnership Flp Agreement Templates Or Form

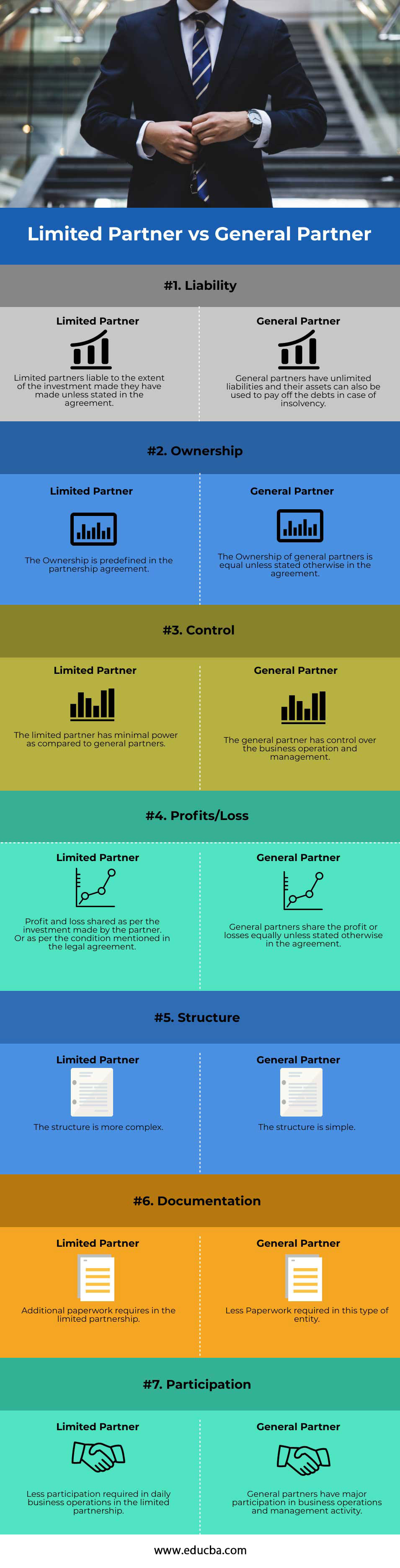

Limited Partner Vs General Partner Top 7 Differences You Should Know

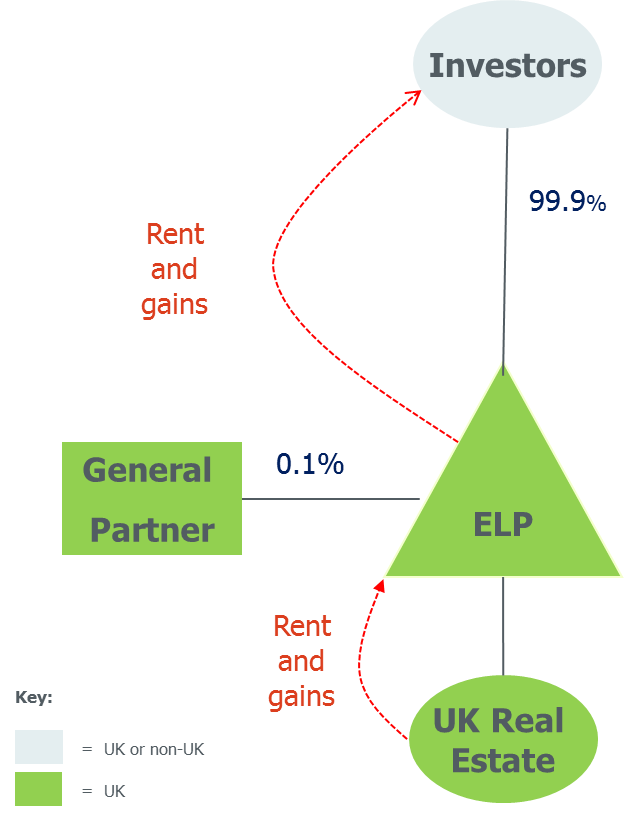

Bryan Cave Leighton Paisner English Limited Partnerships In Real Estate Transactions

Ohio Biz Lawyer Discusses Entity Options Littlejohn Law Llc

4 Types Of Partnership In Business Limited General More

Opening New Accounts Why So Many Different Types Of Partnerships

Limited Partnership Agreement 2 Template By Business In A Box

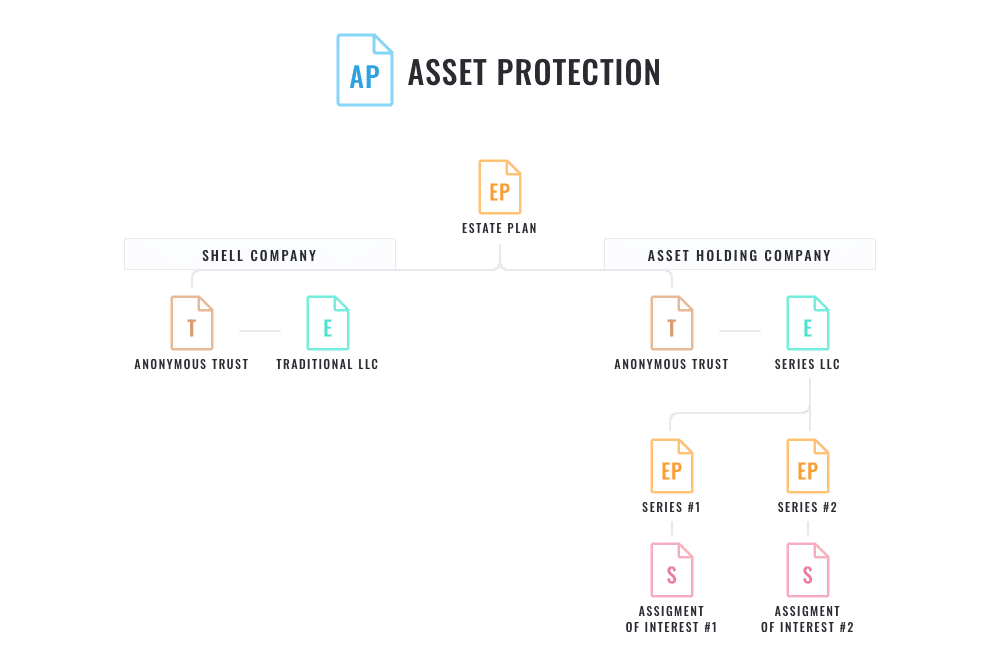

Family Limited Partnership Asset Protection Rjmintz Com Asset Protection Law Center

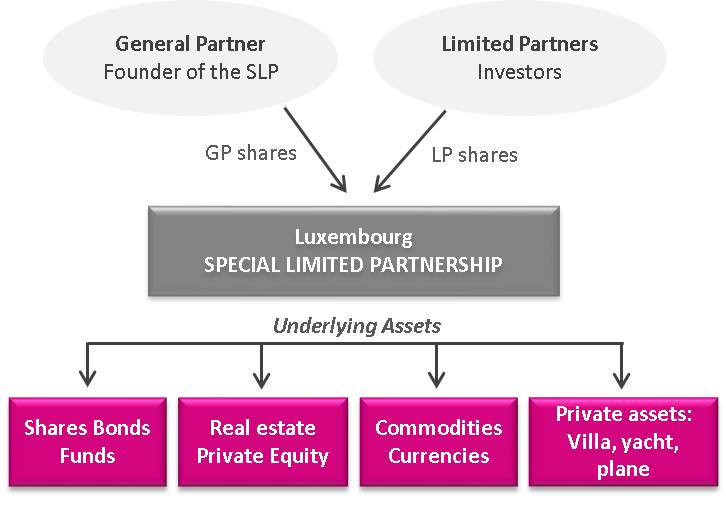

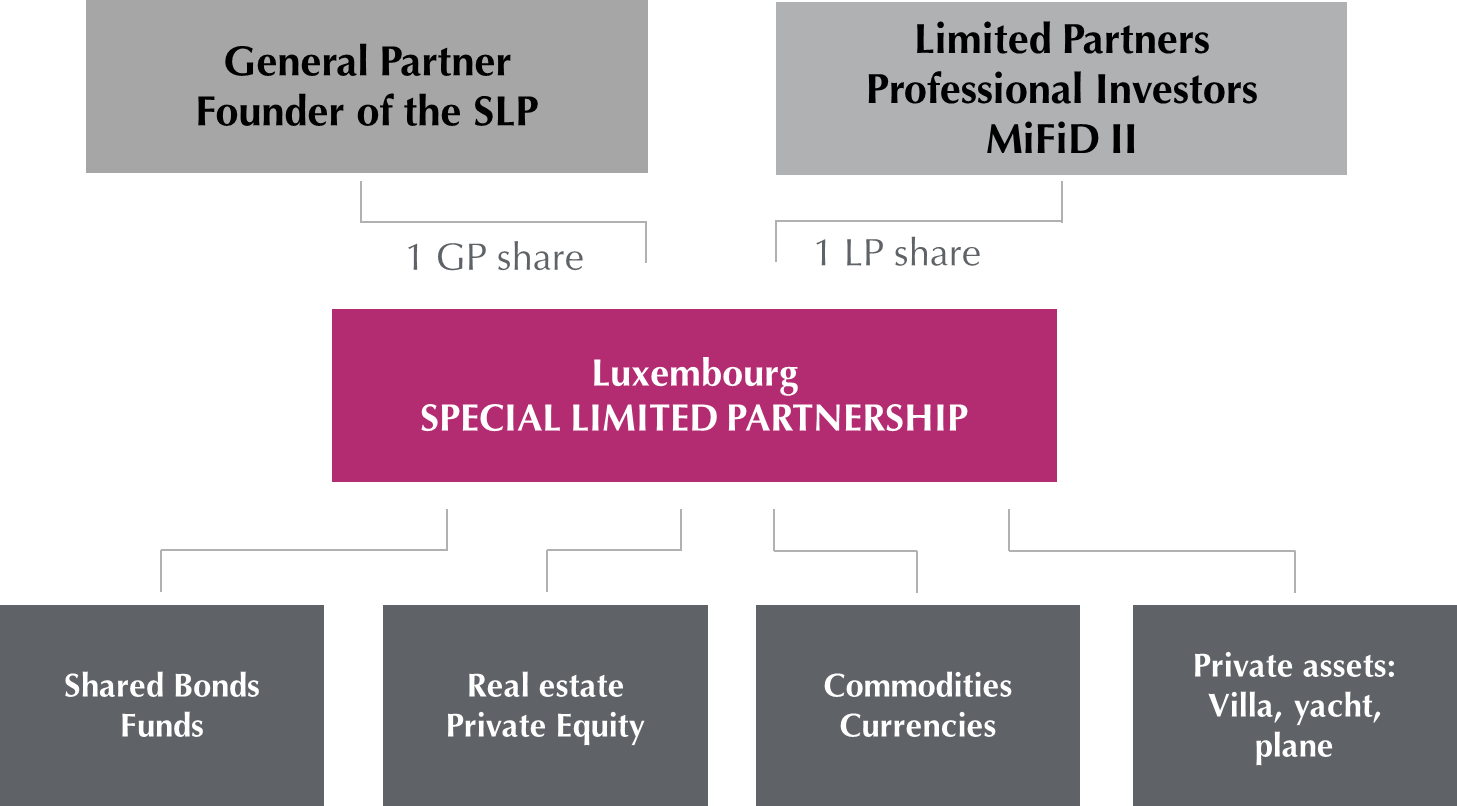

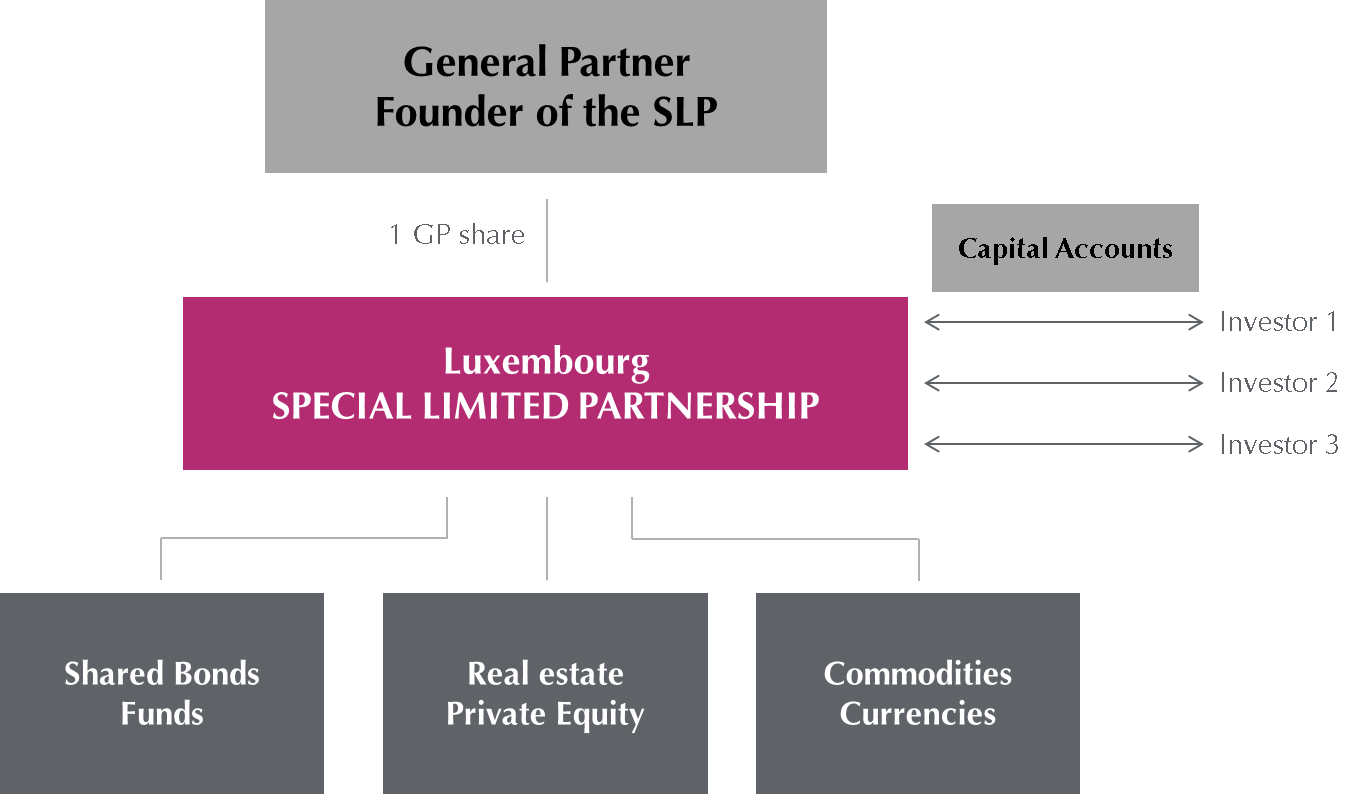

Special Limited Partnership

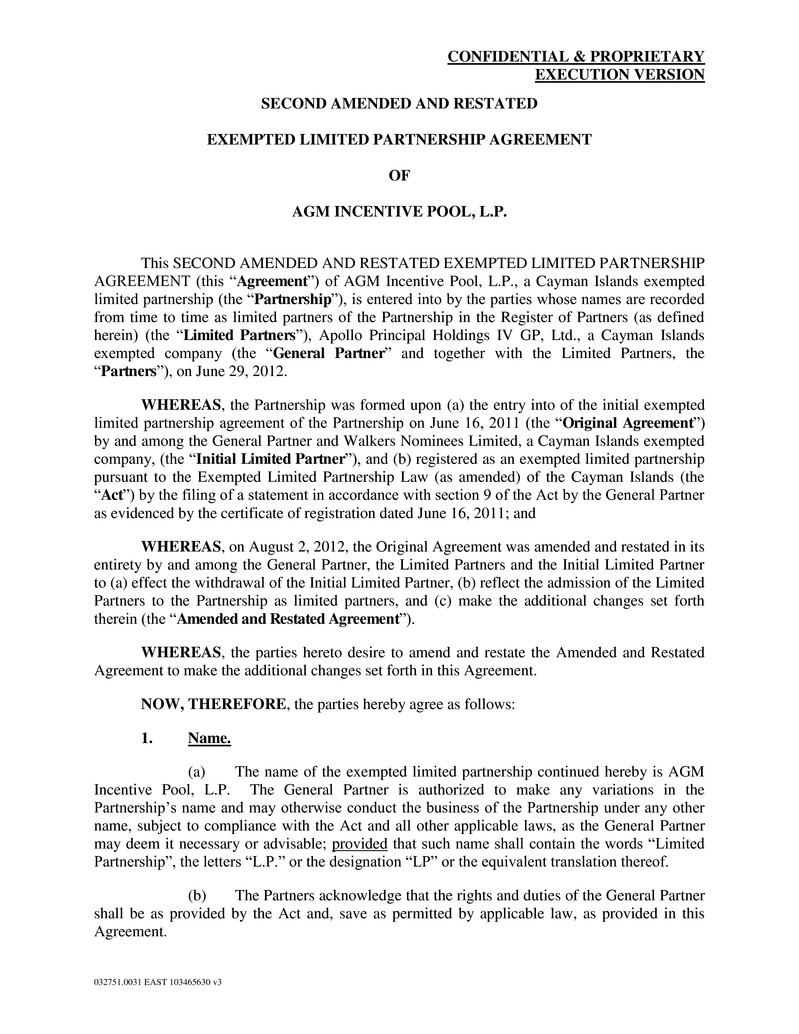

A1049incentivepool

Legal Service Limited Partnership And Limited Liability Partnerships

Limited Liability Limited Partnership Lllp Incorp Services

Sample Limited Partnership Agreement Template

Family Limited Partnerships What You Should Know

Limited Partners Take A Licking In Two Delaware Supreme Court Decisions New York Business Divorce

Pros And Cons Of A Limited Partnership By Allan Lloyd Medium

Limited Partner Vs General Partner Top 7 Differences You Should Know

Limited Partnership For Real Estate Investors Asset Protection For Real Estate Investors Royal Legal Solutions

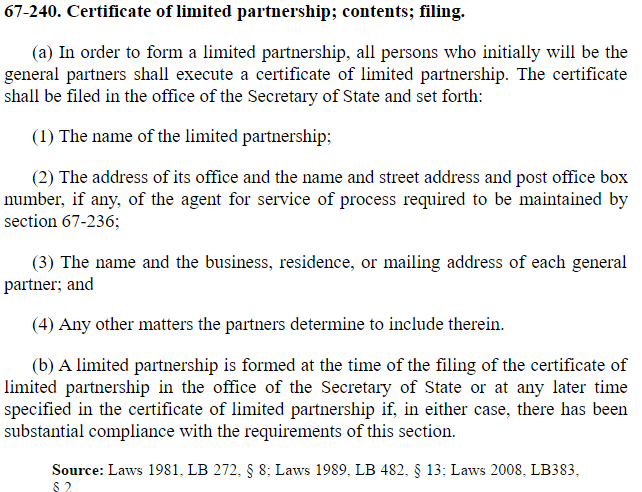

How To Start A Partnership Lp Llp In Nebraska Ne Secretary Of State Start Your Small Business Today

Limited Partnerships Lp Ppt Download

Limited Partnership Structure Ppt Powerpoint Presentation Outline Rules Powerpoint Templates

Family Limited Partnerships Update Diagrams And Bullet Points Feb

Limited Partnerships Types Of Business Ownership

Q Tbn 3aand9gct Aqvkj5e51tpxdjxr5fzx6tlrt8am6h3z8aew8z4 Usqp Cau

Difference Between General Partner And Limited Partner Difference Between

Limited Partnerships Legal Entity Management Articles

Solved 24 Which Of The Following Is Not True Regarding L Chegg Com

The Family Limited Partnership The What The Why And The How Sta Wealth Management

The Irish 1907 Limited Partnership Lexology

What Is A Limited Partnership Type Of Partnership In Business

Family Limited Partnerships Pros And Cons Advisors To The Ultra Affluent Groco

What Is A Limited Liability Partnership Definition Advantages Disadvantages Video Lesson Transcript Study Com

The Ultimate Guide To Investing In Mlps Seeking Alpha

Which Business Structure Is Best For You Part 9a Limited Partnerships General And Limited Partner Limited Partnership Business Structure Investing Money

Limited Partnership Agreement Template By Business In A Box

Family Limited Partnerships Bright Star Blog

Q Tbn 3aand9gctucxhadv3peyxhdyvor Eauaeiwwz0c6f2v8le1b534glg8ttb Usqp Cau

An Introduction To Limited Partnership Funds Who Does What Lcn Legal

Solved 14 In A Limited Partnership A There Are Limit Chegg Com

Limited Partnership What Is It How To Form One Fundera

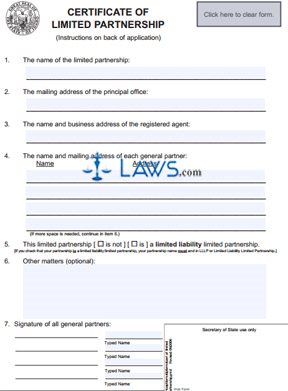

Form 300 Download Fillable Pdf Or Fill Online Certificate Of Limited Partnership For A Limited Partnership Rhode Island Templateroller

Ppt What Is A Family Limited Partnership Flp Powerpoint Presentation Id

Free Form Knp Certificate Of Limited Partnership Free Legal Forms Laws Com

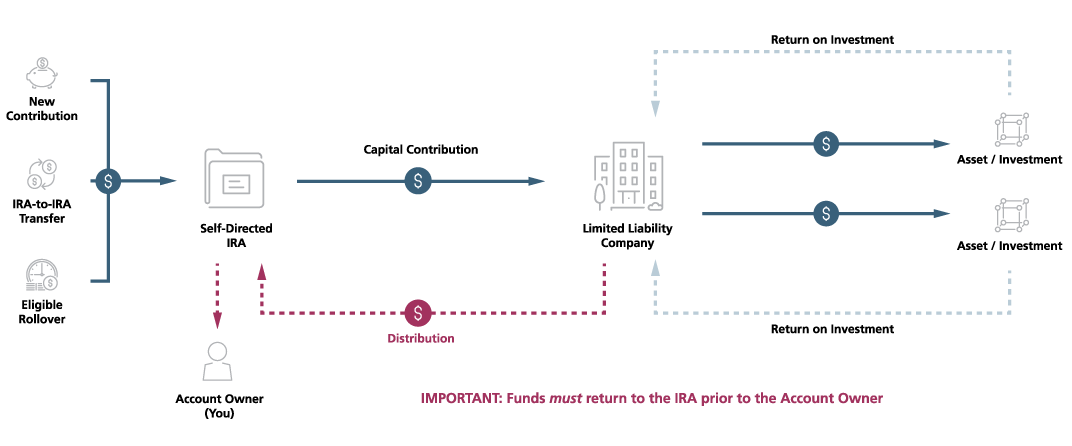

Self Directed Investing In A Limited Liability Company Or Limited Partnership With Qualified Funds Provident Trust Group

Limited Partnership Definition Harvard Business Services Inc

Limited Partners What Are Your Rights Mercer Capital

Form A New Limited Partnership In Ontario Expulsion Of Partner Volun

Oneclass 21 A Limited Partnership Attempts To A B Limit The Number Of Partners Who May Vote At B

Limited Partnership Agreement Template Addictionary

Limited Partnerships A Brief Explanation Ionos

General Partnership Vs Limited Partnership Harvard Business Services

10 Limited Partnership Agreement Templates Pdf Word Free Premium Templates

What Is The Difference Between A Llp An Lp

What Is A Limited Partnership Definition Advantages Disadvantages Video Lesson Transcript Study Com

Master Limited Partnerships Understanding An Evolving Asset Class J P Morgan

Mariemont Capital Limited Partnership Agreement By Matt Wyler Issuu

Family Limited Partnership What Is One And How It Protects You

How To Start A Partnership Lp Llp Lllp Gp In Delaware De Secretary Of State Start Your Small Business Today

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/BusinessPartners-ed07ea2c3c6b4699a539a2ab678865a7.jpg)

Limited Partnership What Is It

Free Printable Limited Partnership Agreement Form Generic

What Is The Difference Between A General And Limited Partnership

Ppm 3 Ppm Company Formation Your Role As A Limited Partner Boardwalk Wealth

Start A Limited Partnership In Switzerland

This Picture Represents The Major Pros And Cons Of A Limited Partnership As You Can See From The Pictur Harvard Law School Harvard Business School Harvard Law

Free Form Id 230 Certificate Of Limited Partnership Free Legal Forms Laws Com

Special Limited Partnership Slp As An Alternative Investment Fund

Is A Limited Partnership Right For My Business Legalzoom Com

Special Limited Partnership Capital Account

Limited Partnerships Lecture Notes 8 Blaw 308 Csun Studocu

Solved In A Limited Partnership The Liability Of A Limit Chegg Com

Dallas Tx Cpa Firm Accounting And Tax Services Dallas Cpa Firm Blog

Liberian Limited Partnerships

Sense Finally Prevails On The Taxation Of Limited Partnerships But Too Many Open Questions Remain Lexology

Financing Our Energy Future Act

Business Structures

Limited Partnerships Incorp Services

Lp Corner Us Private Equity Fund Structure The Limited Partnership Allen Latta S Thoughts On Private Equity Etc

Http Www Cftc Gov Stellent Groups Public Otherif Documents Ifdocs Ggcdermarexhibitg3 Pdf

Q Tbn 3aand9gcqs1rvxon9 Wf9rizducbwjh Nhe11hcwkvlhp Xibyzlompedk Usqp Cau

Why Do You Still Operate Your Business Under A Limited Partnership Estate Planning Probate Attorneys

Family Limited Partnerships Distributions And Valuations Ati Capital Group Of Colorado

The Partnership Act 12

The Hong Kong Limited Partnership Fund Explained

Is Starting A Limited Partnership Best For Your Business

Is A Limited Partnership Right For My Business Legalzoom Com

Family Limited Partnerships